Preparing Financially for Long-Term Care

Do I Need a Long-Term Care Plan?

It is reasonable to assume that if you live to 80 or longer you could need care assistance for at least a few years. This will be an increased expense that will affect your income.

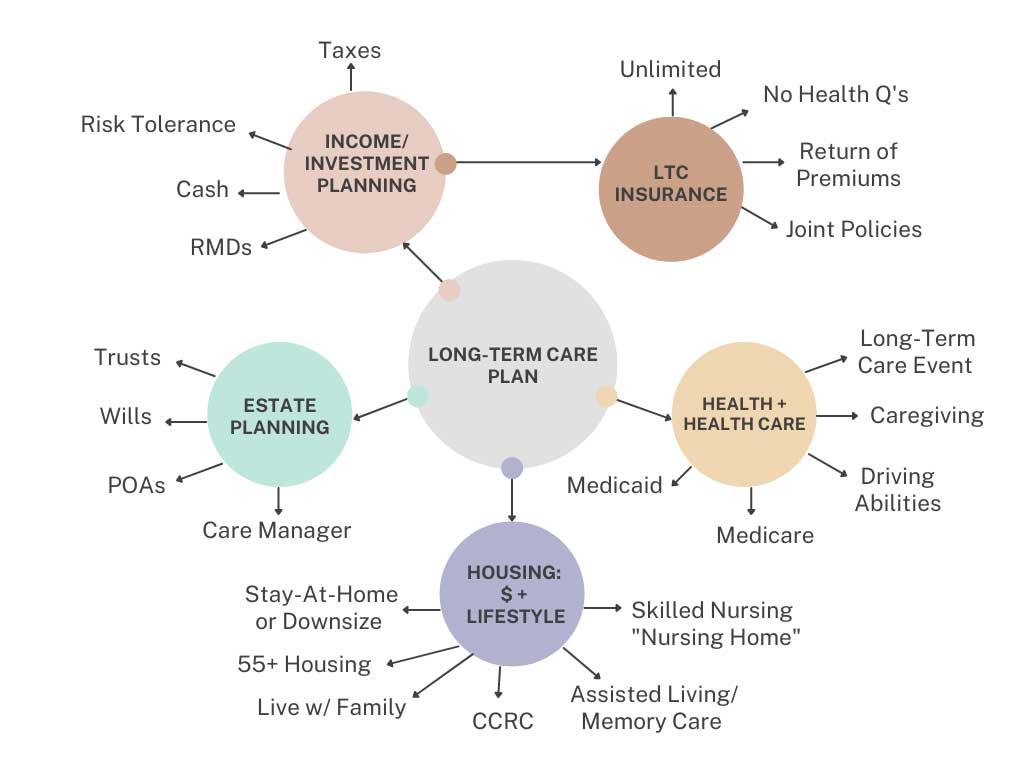

A Long-Term Care Plan addresses longevity, how you will remain safe at home or at a retirement community, and mitigates the consequences of needing care and paying for it. Often the emotional, physical, and financial consequences are felt most deeply by the caregiver, typically a spouse or adult child.

Receiving outside care can help offset these consequences.

Many people automatically think planning for long-term care consequences simply means buying insurance. This is not a plan. A long-term care insurance policy could pay for your plan, but it is not the plan.

Long-Term Care insurance is just one way to protect your family, income, and lifestyle from a long-term care event and it should be examined. For example, many people are unaware of recent renovations in long-term care insurance options available:

- Don’t use it? Get your money back.

- Contract guarantee of no future rate increases.

- Plans pay ‘cash’ so that you use the money how you see fit.

Ultimately, Long-Term Care Planning can be complex and it can take time to understand how the pieces of retirement planning figure in a long-term care event for you and your family.

When should you start Long-Term Care Planning?

Individuals in their mid-50s should start planning for a long-term care event. Planning ahead will spare your family from hardship in the future.

We often hear, “I’m too young!” It’s not just for you. The reality of caregiving for parents, a loved one, or a spouse can come much sooner in life than expected.

What else is there to Long-Term Care Planning besides insurance?

In Long-Term Care Planning, we look at estate planning, Medicare, Medicaid and self-insuring, which means your retirement income available to pay for long-term care depends on:

- Lifestyle

- Taxes

- Market Conditions

- Liquidity

- Legacy Assets

- Lost investment Opportunities

- CCRC Buy-Ins (Continuing Care Retirement Communities)

- Charities

- Other Obligations

What can NorthStar do for your Long-Term Care Plan?

We’ll educate you on the risks and consequences due to a long-term care event and create a meaningful funding plan to protect your family, lifestyle, and income. We’ll create a plan together that addresses these care cost questions and lifestyle changes:

- Where and how do you plan to receive care? Staying at home or with family? Planning to move to a retirement community?

- Do you have a financial plan that covers long-term care expenses for you and/or your spouse?

- Do you understand what Medicare and Medicaid will pay for?

- Do you understand what benefits are available to you and/or your spouse as a veteran?

Potential budget changes for couples:

- One person is living in the home and the other person is living in a facility.

- Both people are living at home, but one has care brought in.

- Both people are living at home, both have care brought in.

- Couple moves to a 55+ retirement community or CCRC (Continuing Care Retirement Community)

For single persons:

- You are at home and care is brought in.

- You are living in a facility but still have expenses at home (double expenses).

- You move to a 55+ retirement community or CCRC (Continuing Care Retirement Community).

NorthStar can help you prepare to answer questions like this in a Long-Term Care Plan and there are many more planning options available today than most people realize.

Give NorthStar a call today for your complimentary long-term care planning session by calling (864) 297-0792.