We'll work to reduce taxes on your wealth so you can enjoy more of your money.

Retirement Tax Planning

When tax rules are up in the air, soon to change, or recently changed, you may feel like your tax foundation has become unsteady under your feet. You may feel as though you just got a handle on your tax savings strategy.

Questions begin swirling through your mind like:

- How can I use the current unpredictability around taxes to my benefit?

- Are my investments still aligned with my tax strategies?

- Will I likely pay more in taxes in the coming years?

Less money in taxes = more for you to enjoy.

Our tax reduction strategies are some of the most important planning our team, and on-staff CPA & Financial Advisor Travis Smith, does. The last thing you want is to save well your entire life, only to have it eaten up by taxes in the end. That’s why your retirement deserves a committed plan for taxes.

Without retirement tax planning, you could end up paying several thousands more than you were thinking.

When you’re a high earner, one thing is sure. Changes to the tax rules can have an expensive impact on how much you keep.

With every new change, you have the option of running toward the hidden opportunities that uncertainty presents.

OR

You can leave things “as is” and deal with any expensive surprises later (when it’s probably too late to do anything about it).

End result by planning:

- Optimize Social Security benefits

- Substantially reduce taxes in retirement

- Better prepare for tax law changes that always come

- Build a plan for lifetime tax-efficient income

- Reduce investment risks

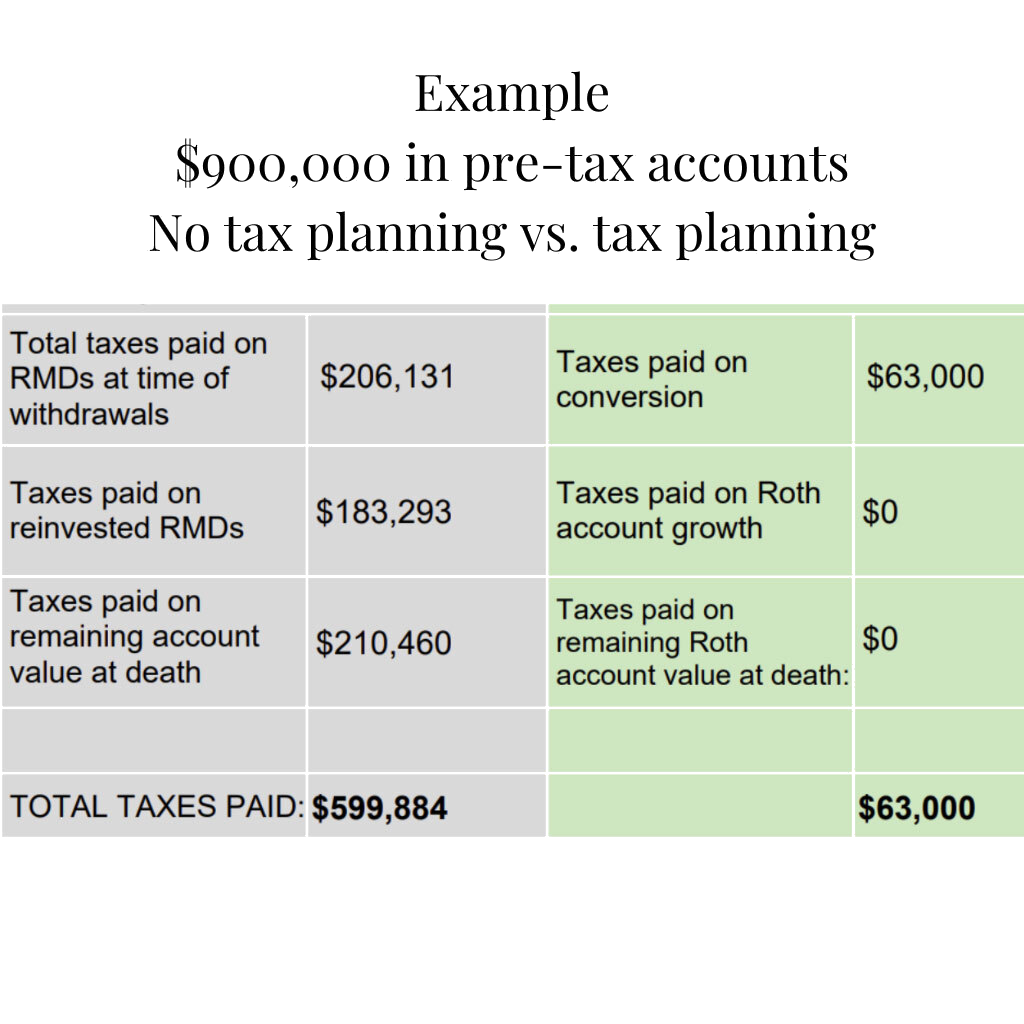

Disclosure: Results will vary based on the amount of qualified ‘pre-tax’ funds a client has. This illustration is based on a client having approx. $900,000 in pre-tax deferred accounts (IRA’s/401(k)’s, etc.) The analysis assumes that one person lives to be ninety and that taxes do increase in the future. It also assumes a 7 percent rate of return and that taxes are going up in the future. With our tax planning assistance, this client was able to pay only $63,000 in taxes vs. $599,844 if they had not done tax planning.