Home » Financial Services » Tax Planning Strategies

When tax rules are up in the air, soon to change, or recently changed, you may feel like your tax foundation has become unsteady under your feet. You may feel as though you just got a handle on your tax savings strategy.

Questions begin swirling through your mind like:

Our tax reduction strategies are some of the most important planning our team, and on-staff CPA & Financial Advisor Travis Smith, does. The last thing you want is to save well your entire life, only to have it eaten up by taxes in the end. That’s why your retirement deserves a committed plan for taxes.

Without retirement tax planning, you could end up paying several thousands more than you were thinking.

When you’re a high earner, one thing is sure. Changes to the tax rules can have an expensive impact on how much you keep.

With every new change, you have the option of running toward the hidden opportunities that uncertainty presents.

OR

You can leave things “as is” and deal with any expensive surprises later (when it’s probably too late to do anything about it).

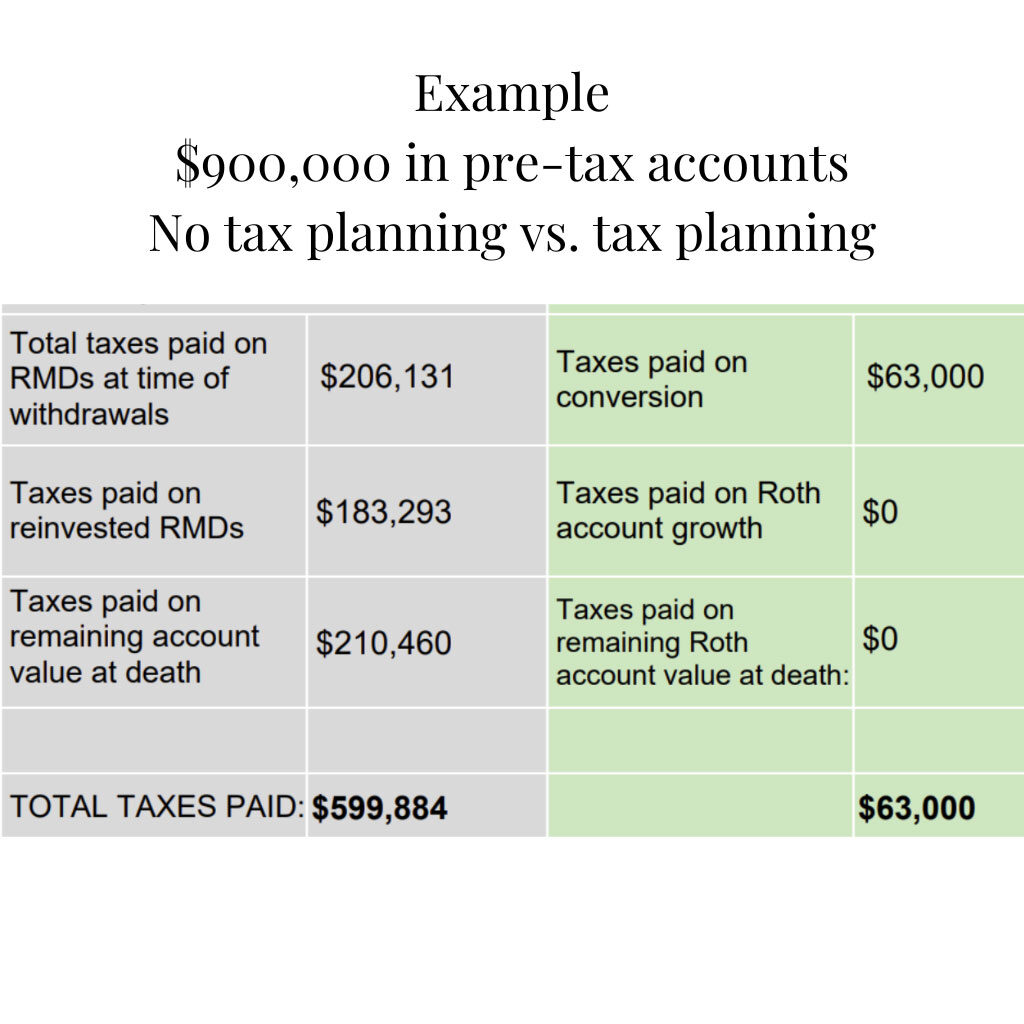

Disclosure: Results will vary based on the amount of qualified ‘pre-tax’ funds a client has. This illustration is based on a client having approx. $900,000 in pre-tax deferred accounts (IRA’s/401(k)’s, etc.) The analysis assumes that one person lives to be ninety and that taxes do increase in the future. It also assumes a 7 percent rate of return and that taxes are going up in the future. With our tax planning assistance, this client was able to pay only $63,000 in taxes vs. $599,844 if they had not done tax planning.

One of our goals is to get our clients as close to the zero tax-bracket as possible.

Tracking your exposure to various taxes (e.g. ordinary income tax, capital gains tax, the alternative minimum tax, the net investment income tax, etc.), and your rights to various credits and deductions, requires time and effort.

Along with the expertise to make informed decisions about your investments, we can ensure that you are maximizing your tax savings during this phase of your life.

Call us today for a complimentary consultation.

NorthStar Financial & Retirement Planning (864) 297-0762

Our 5-STEP RETIREMENT GUIDE will show you what information is needed to understand the risks associated with retirement so that you can make smart retirement planning decisions.

It can be difficult to decide where to go for financial advice. At NorthStar, we believe in the Golden Rule: treat others the way you would like to be treated. We understand that people can be apprehensive when asking for information and assistance.

Our promise to you is that we will be respectful of your time and there will be no pressure or obligation to do business with us. We want you to be comfortable from the minute we meet!

Main Office

412 Pettigru Street, Suite A

Greenville, SC 29601

Phone: (864) 297-0762

Fax: (800) 716-9883

Email: [email protected]

714 Oakland St

Hendersonville, NC 28791

Phone: 864-297-0762

Fax: (800) 716-9883

Biltmore Park Town Square

28 SCHENCK Parkway

Building 2B, Suite 200

Asheville, NC 28803

Phone: 864-297-0762

Fax: (800) 716-9883

We Serve Clients Virtually Across the United States

Schedule an appointment today!

Phone: 864-297-0762

Investment Advisory Services offered through Delta Investment Management, LLC, a Registered Investment Advisor. NorthStar Financial & Retirement Planning, LLC and Delta Investment Management, LLC are not affiliated. Annuity guarantees, including optional riders, are backed by the financial strength and claims-paying ability of the issuing insurance company. Insurance products, including annuities, offered through NorthStar Financial and Retirement Planning. Life and annuity licensed in License No: 5538278.

Investing involves the risk of loss. Past performance is not an indication of future performance.